How a Deal Room Helps You Evaluate Risk

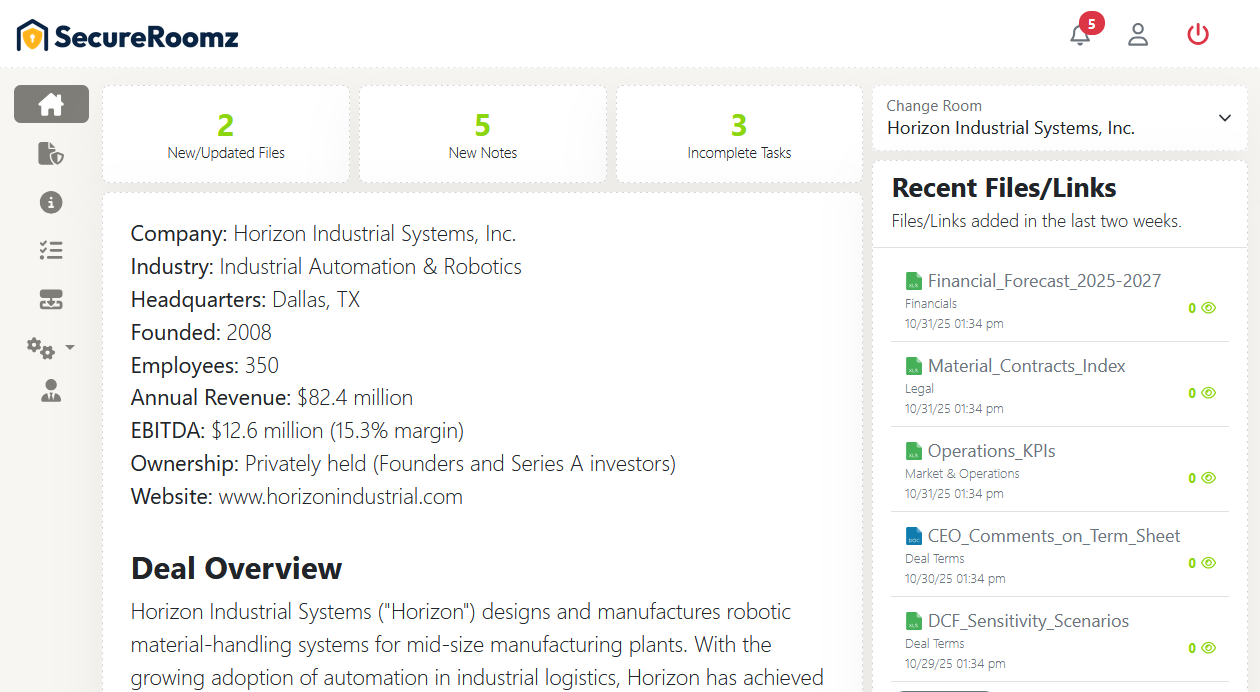

Every deal carries uncertainty, whether financial, operational, legal, or market related. A Deal Room does more than store documents, it helps your team analyze and act on them. It connects uploaded files, assigned tasks, and collaborative discussions into one process. This allows your investment committee to focus on what matters most, determining whether the deal makes sense.